Right to Information – How to check EMI of Loans

by

Ashok Goyal

·

26/06/2022

Right to Information – How to check EMI of Loans

June 30th, 2022

Ashok Goyal

Ashok Goyal

Are You worried about EMI even after having paid all Equated Monthly Installments of Bank Loans?

Even after regular repayment of personal loans, vehicle loans, consumer loans, home loans, and educational loans the banks and lending institutions inform the borrower that their loan is still outstanding even after the full term of repayment of all EMI’s as per Bank’s instructions at the time of disbursement of the loan amount. The borrowers get confused and are not in a position to reconcile. This article explains the reasons for the confusion of the borrowers on the one side and the recovery machinery of the banks and financial institutions on the other side. The borrowers need to know about the following basics of EMI or equated monthly installments;

- Whether the rate of interest is fixed or floating. If the rate of interest is floating then how can you expect the EMI to remain constant and mind that there is no concept like a fixed rate of interest as it is subjected to a reset clause by all the banks and term lending institutions? Now the even new concept of benchmark prime lending rate, BPLR, which is also subject to change can vibrate the EMI of the loan taken by you.

- Whether the rate of interest is simple or compounded. If simple then it is OK but if it is compounded then whether it is compounded yearly, half-yearly, or quarterly. Presently all banks are compounding their interests monthly that is to say that on the last date interest for the current month is applied and interest for the next month is applied to the balance after adding the interest applied for the current month. Check with the Bank or lending institution about the method of compounding while fixing the EMI of the loan.

- Whether there was any gestation period or moratorium period. If yes inquire about the interest applied during such gestation or moratorium period. If it was to be paid by the borrower, have you paid it? If not, then ask if such interest has been loaded in principle while fixing the EMI.

- Whether any charges like inspection charges, advocate fees, architect or valuers fees or cost of insurance is being debited to your loan account of other accounts like saving or current or cash credit. If it is another account then there is no problem and if it is debited to your loan account without having been paid by you the same day, it will have a money multiplier effect as even a small component of interest on such charges will make your loan account irregular forcing penal provisions of charging penal interest getting activated automatically. Ask the bank to recover such charges from other accounts or inform you through SMS so that they can be paid on the same to avoid penal interest which will go on multiplying and disturbing the EMI. At a later stage, it may become troublesome for you and complicated even for the banks to rectify as it will involve tedious IT solutions.

- Do you know that smart banks like HDFC, ICICI, and even almost all banks prefer not to disturb the EMI on change or increase of the rate of interest resulting in an increase in the total Term of the Bank Loan?

To deal with the situation, the customers have to be smarter than the Bankers, and to protect your interests Read the full article and keep yourself ahead of your lender.

Tags: Car LoansEducational LoansGold LoansHome LoansPersonal LoansProperty LoansRight to Information - RTI

Ashok Goyal

Hi members, I am Ashok Goyal from Rajpura - Punjab, a town near Chandigarh. I am a retired Chief Manager from a Top Nationalized Bank in India with 35 years of experience. I am the CEO-cum-Founder of this site made for Young and Old, Technical and Non Technical members to spread their knowledge across the Globe. I am a Science Graduate with an M.A. in Economics and C.A.I.I.B. (Certified Associate Life Member of Indian Institute of Banking and Finance since 1980 and a Social Worker authoring many Blogs for the benefit of the Public in General. I Graduated from Patel Memorial National College, Rajpura - 140401 and secured a Master's Degree in Economics from Punjabi University, Patiala - 147001 Punjab, India. Expert in Legal and Money Matters, may it be Banking, Investments, and Insurance or Fraud investigations. My Hobby is to share Knowledge and alarm the younger generations about the practical implications of transacting online. I am available at many Social Networking Sites. I am health conscious and like reading deeply about anything related to health and nutrition. In the case of any violation of objectionable content, the images on my authored links or on this site, you can either report me directly or you can file a DMCA complaint about the removal of the content. I do not like spammers and never hesitate to report the abuse of my profile information. I am the owner of the WQAINDIA Brand hosting self-hosted Question Answers Site at Web Question Answers. In Jan 2016, I founded Samadhan Kender at Rajpura - which is now talk of the down. In January 2017, keeping in view the Identity Crisis in India I found that the Public was facing difficulties in their CIBIL Reports - I started my best ever venture at CIBIL Consultants to solve the CIBIL Problems of the Public online. CIBIL Consultants is having its client base in all 17 states in India.

© Copyright - Ashok Goyal – ALL RIGHTS RESERVED: This is my original work and I do not like any content to be copied or posted anywhere on the web or elsewhere. All the articles available on my social profiles are exclusively owned by me. If you like my articles then you can visit my articles and provide the URL as a link, without any copyright infringement, on the website or blogs which are not having any adult content related to sex, violence, hate-redness, or religious fundamentalism as per Google or Facebook TOC.

DISCLAIMER: The information on this site or elsewhere - under my Profile Name is for general information purposes only. The information provided by me is simply educative to the best of my knowledge and belief. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability about the information, products, and services being displayed on this website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising out of or in connection with the use of this website or my profile anywhere on the web. We welcome feedback, comments or healthy criticism on any article or content on this site or my own work anywhere on the web. I owe my success on the web to IndiaStudyChannel to Tony John, Webmaster at ISC. I am also a featured author at HubPages, Global Site for writers and Authors. This site is dedicated to my countrymen to sharpen their online skills to compete for the world. The public can also get their CIBIL Reports rectified professionally at very low prices – when big corporations are charging as much as Rs.25000 per person per Credit Report.

You may also like...

June 30th, 2022

June 30th, 2022

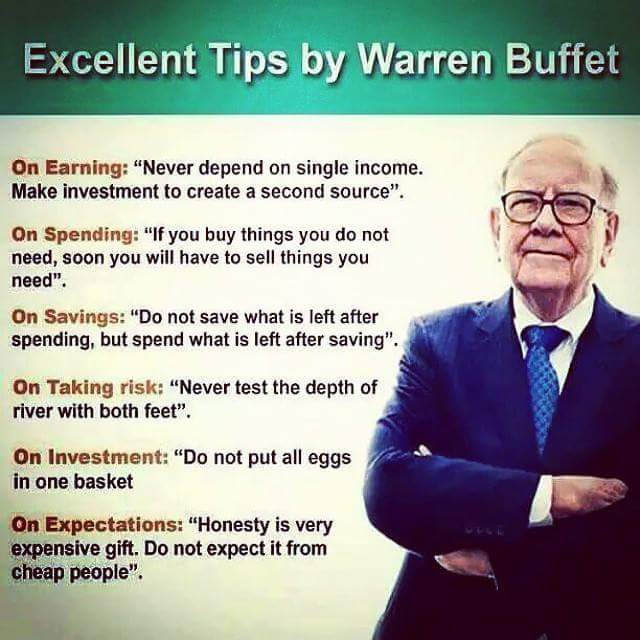

As I’m unable to add image to this post, I will try to show you the image in text from…