Visit Samadhan Kender to open Sukanya Samridhi Deposit with SBI

Visit Samadhan Kender to open Sukanya Samridhi Deposit with SBI

Enter Your Email

Union Budget 2015 is being unfolded by the taxation experts and it will come as a big shock the depositors who used to save regularly through Recurring Deposit schemes with Banks in India. Finance Minister has cunningly included the Recurring Deposits in the TDS net by bringing the RD at par with Fixed Deposits. Now if you are having a fixed deposit of say Rs.5 lac with a bank yielding monthly interest of say Rs.4000/- per month on which bank will already be deducting TDS of Rs.400/- per month at the rate of 10% if PAN is given to the bank and at the rate of Rs.800/- per month being 20% if PAN is not provided to the Bank. If the interest amount of Rs.4000/- net of TDS being Rs.3600/- or Rs.3200/-, as the case may be, is reinvested in Recurring Deposit then interest earned on such RD is again taxable u/s 194A to the tune of 10% or 20% as the case may be becuase the interest amount on Fixed Deposit and Recurring Deposit will exceed the ceiling of Rs.10000/-. This is a clear cut case of double taxation being imposed on the depositors. Due to pro-capitalist policies of the Government of India, interest rates have already been lowered to less than 9% per annum to lend money to billionaire MNC’s at lower interest in the name of boosting economy and employment. The senior citizens in India are finding it very difficult to make both ends meet due to rising inflation which is the outcome of money supply at lower rates. On the one hand the money has become cheaper and on the other hand the rupee gets devalued due to inflationary trend caused by more and more supply of money at cheaper rates.

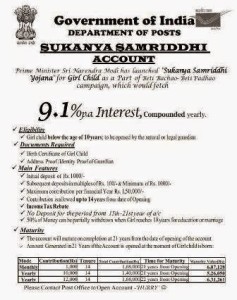

In such a scenario what is the option available to make savings which can yield much more to neutralize the rate of inflation and depreciation of rupee. Union Budget 2015 has come out with Sukanya Samriddhi Yojana for investing the money in the name of the girl child below the age of 10 years by natural or legal guardians. Salient features of the Sukanya Samriddhi Yojana are as under:

- The Sukanya Samriddhi Yojana account is similar to Public Provident Fund which will attract interest @9.1% per annum compounded yearly. The account can be opened with initial deposit of Rs.1000/- and subsequent deposits can be in multiples of Rs.100/- with minimum of Rs.1000/- in such a way that the maximum contribution per financial year (1st April to 31st March) does not exceed Rs.150000/-.

- Contribution can be made for 14 years from the date of opening of the account which will mature after 21 years from the date of opening of the account.

- The subscriber can not deposit any amount in the account from 15th to 21st year of opening of account under Sukanya Samriddhi Yojana.

- Withdrawal of 50% of money can be withdrawn for education or marriage of the girl child after the girl child attains the age of 18 years.

- If an account is opened on the immediate birth of the girl child then the following maturity values are payable if the regular contributions are made at regular intervals though the subscriber is free to make irregular contributions at irregular intervals.

Mode |

Contribution (Rs) |

Tenure |

Total Cont. |

Maturity |

Maturity Value |

Monthly |

1000 |

14 yr |

168000 |

21 years |

607128 |

Yearly |

10000 |

14 yr |

140000 |

21 years |

526050 |

Yearly |

12000 |

14 yr |

168000 |

21 years |

631268 |

September 23rd, 2021

September 23rd, 2021

As I’m unable to add image to this post, I will try to show you the image in text from…